I don't mean a GREAT_BIG_GIGANTIC shift... I mean a GREAT/TERRIFICALLY/ AWESOME/SPLENDID Shift! If you didn't already see our Blog-A-Birth-Aversary Post, let me catch you up to speed. SPL has JUST celebrated its one year anniversary, and in the spirit of celebrating we want to reveal a spring surprise that is only going to make the content we bring to you at Sylvan Park Life BETTER! Bottom Line: We want YOU to know US!

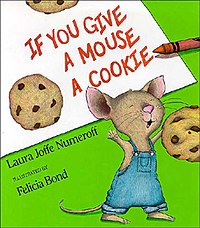

Okay, now for the details - and the story. If you have ever followed my Tumblr account, you may have read THIS POST back in November of 2012 (just 4 short months after Ty and I married). In case you didn't get to read it, let me explain this If you Give a Mouse a Cookie Phenomenon.

The 1980s children's book If you Give a Mouse a Cookie had more mature intentions than I originally realized. The story finds the mouse constantly distracted by his next MUST HAVE. The little mouse's friend, Estuardo gives the mouse a cookie, and then the mouse wants some milk. This appears benign but then the little guys needs to clean his face, and so on. His friend runs around trying to give all of these things to the mouse, while jumping from one unfinished project to the next. In the end the mouse and Estuardo end up exactly where they started: the mouse wants a cookie.

Here at SPL, we have come full circle like Estuardo and the mouse. We started our home journey with the LARGER goal of home ownership aka paying off our mortgage, but in the last year (as you can see in this blog) it has seemingly gotten overshadowed by home renovation. At the end of a year we are still wanting a cookie, er, to pay off our home in a timely manner.

Thus the shift: We want to bring you along in this part of our journey too.

Let's Start from the Very Beginning, A very good place to start!

(yes, I am singing out loud as I write this)

This desire to pay off our home early in our marriage was also fueled by the desire to own a dog.

Here is the initial idea we had while we were living in the Condo in November 2012:

To own a dog, we felt like we needed a yard, and thus a proper home. To buy a home, we need to pay off the condo we are currently living in within a reasonable time period. Together, Ty and I calculated how much extra per month we could put towards the principle of our mortgage by looking at our BUDGET and this MORTGAGE CALCULATOR, and using this amortization* (payments over multiple periods to include things like interest, additional payments to principle, etc) schedule. We also refinanced our condo from a 30 year to a 15 year loan to reduce our interest payment, and get a BIGGER bang for our mortgage payment bucks each month (more money going to principle rather than paying down interest).

AND THEN (play celebratory trumpet), opportunity struck!

I will leave you hanging until next Friday, but be on the look out for our usual Monday morning post.

You won't be disappointed!

If you are interested in exploring some of the tools we used to calculate our budget and mortgage payoff plan, just click on the links above.

No comments :

Post a Comment

Join the conversation! We love hearing your ideas, seeing your DIY projects, and answering your questions.